7 Best Online Bookkeeping Services for Small Businesses

Online bookkeeping services, also called virtual bookkeeping services, are a very affordable alternative to the traditional employee bookkeeper. To put this in perspective, a bookkeeper’s average salary is $44,527. On the other hand, most online bookkeeping services start at the $200-$400 per month range, with more advanced invest in tax free municipal bonds for lower taxes and risk solutions in the $600-$800 range still being significantly cheaper than hiring a bookkeeping employee. QuickBooks Live is our top pick for online bookkeeping services because it offers cleanup bookkeeping services that vary based on your company’s needs for your first month.

Spend More Time on Your Main Business

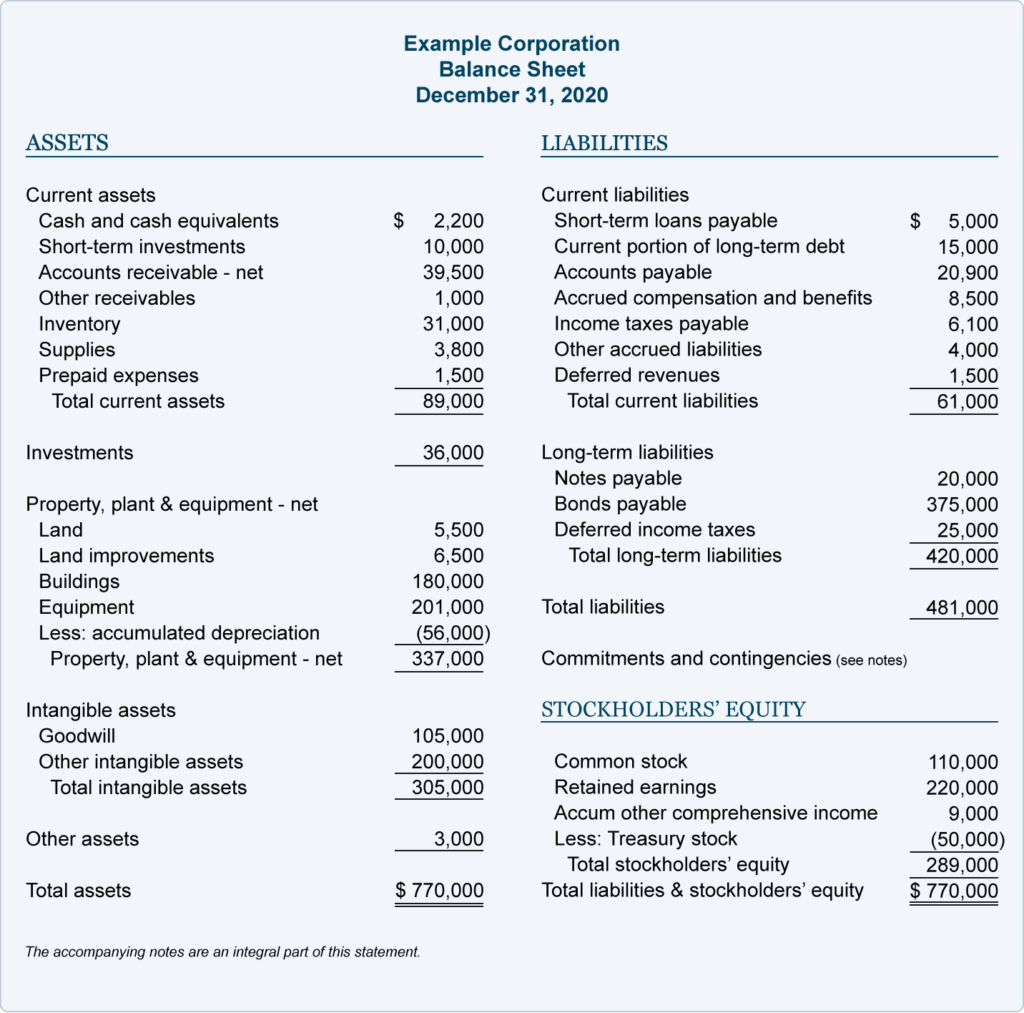

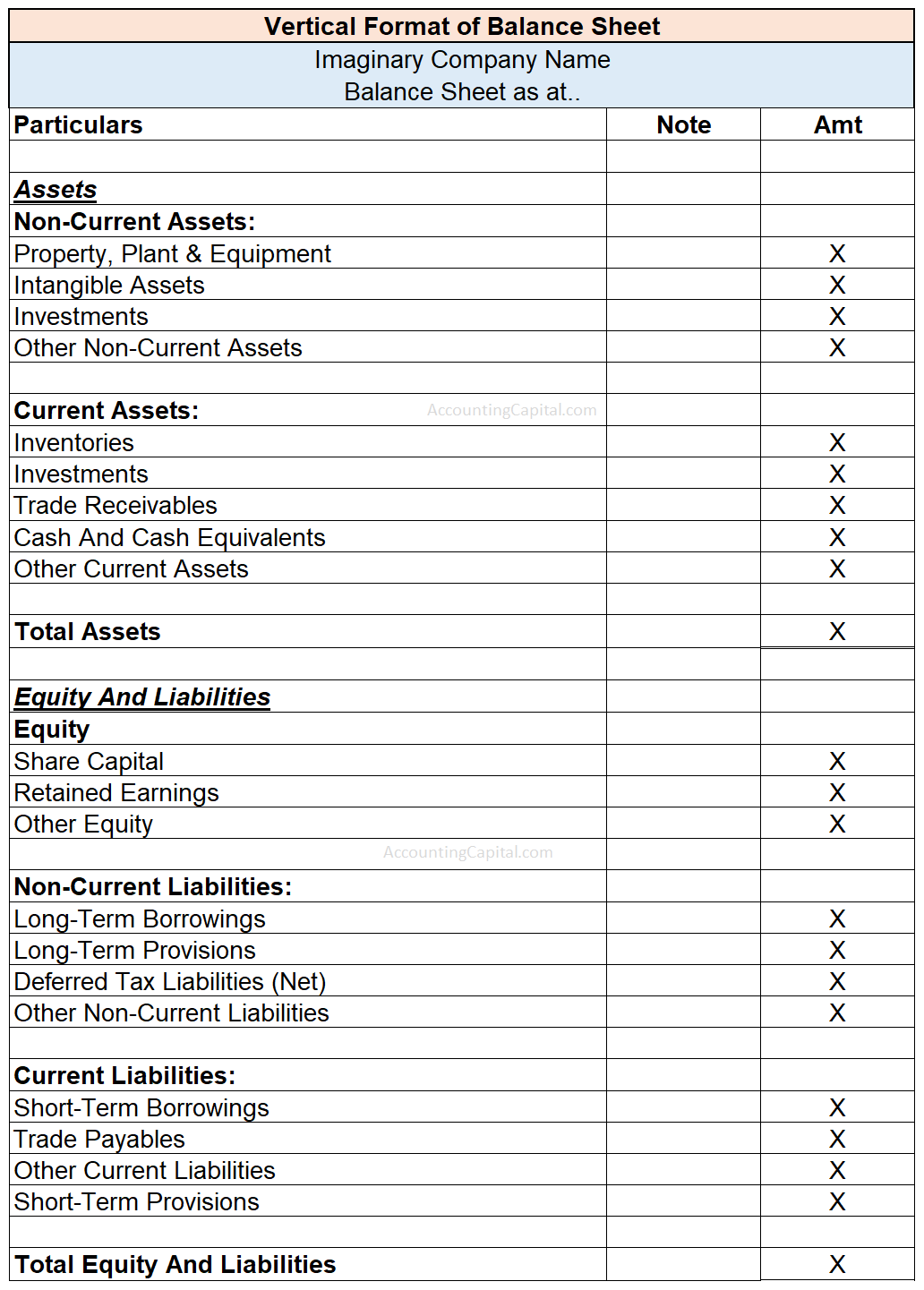

Feel confident about your business and your books with QuickBooks experts by your side to help you succeed. At Business.org, our research is meant to offer general product and service recommendations. We don’t guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products and services. Want to learn more about bookkeeping before you sign up for a virtual provider? Our article on business bookkeeping basics gives you more information on how to do bookkeeping and why. Typically, you’d only get detailed financial statements like this through a CFO — which means Merritt gives you some of the best aspects of having a CFO without the high cost.

Powerful financial reporting

This service is ideal for business owners who want to get their bookkeeping in order but don’t have the time or resources to do it themselves. Bench provides a hybrid of affordable professional bookkeeping services and accounting software. A professional bookkeeper will set up your accounts and send you financial reports regularly.

Each may offer slightly different services and features, so choose the one that best suits your business needs. If financial terms like income and expense, debits and credits, and balance sheet make you cringe, you probably aren’t alone. And unless you have the budget to hire an in-house accounting department, you might not know what your options are in terms of making sure your bookkeeping gets done properly and on time. Unlike most other outsourced bookkeepers on our list, Merritt Bookkeeping doesn’t offer any in-house add-ons for payroll and tax services. If you were hoping for a one-stop shop that can tackle all of your financial needs, Merritt might not be the right choice for you.

A small business can likely do all its own bookkeeping using accounting software. Many of the operations are automated in the software, making it easy to get accurate debits and credits entered. For pricing, we considered whether a service offers a free trial or a free version of its software as well as the affordability of its lowest and highest price tiers. Bookkeeper360 is best for businesses that occasionally need bookkeeping services as well as those that want integrations with third-party tools.

Accurate financial statements are a critical component to managing any business, and QuickBooks makes it easy to generate and send financial statements in just a few clicks. Your bookkeeper reconciles your accounts, categorizes your transactions, and produces your financial statements. They also make adjustments to your books to ensure they’re tax-compliant. Occasionally your bookkeeper might need your input on things like categorizing a transaction properly, but we try our best to make bookkeeping as hands-off as possible for you.

FAQs On Online Bookkeeping Services

Its bookkeeping service comes with its Enterprise plan, which costs $399 balance sheet accounts per month when billed annually. You’ll get a dedicated accountant, year-round tax advice, tax prep, bookkeeping and financial reports. FreshBooks’ online bookkeeping services help you protect your profits, save you time, and grow your business.

- Along with typical financial reporting (like profit and loss reports and balance sheets), you’ll get a KPI (key performance indicator) report and profitability analysis, among others.

- However, as with any in-person accounting professionals you’d trust with your financial data, you should always verify a bookkeeping firm’s credentials before committing to a monthly plan.

- 1-800Accountant offers full-service accounting services, including tax preparation and advisory to small businesses.

- Once your bookkeeper receives all the necessary documentation, they’ll typically complete your cleanup within 30 days.

- Accountants are more specialized, so not every company has an in-house accountant.

- Part of what makes Bench unique is that we blend together the human touch with modern technology.

Book a demo with our friendly team of experts

QuickBooks Online offers Expert Full Service Payroll for an additional cost. In addition to being one of the best online bookkeeping services around, FreshBooks offers 100% compliant tax preparation, taking the stress out of this important but time-consuming process. IgniteSpot Accounting boasts a more personalized approach to outsourced accounting services. Its bookkeeping packages include certified virtual bookkeepers and a dedicated accountant for your business. These services are usually virtual, as well, so it doesn’t require you to trudge to an accountant’s office to start their services.

Bookkeepers will usually prepare relevant records and tax documents, and then forward this information to an accountant, who will then prepare the actual tax return. While there are certain scenarios where it makes sense to have a dedicated bookkeeper (or several) on your staff, this is typically reserved for very large companies. For the vast financial statements majority of businesses, the job of bookkeeping is too small for a department but too much for the owner.