Balance Sheet Form Template

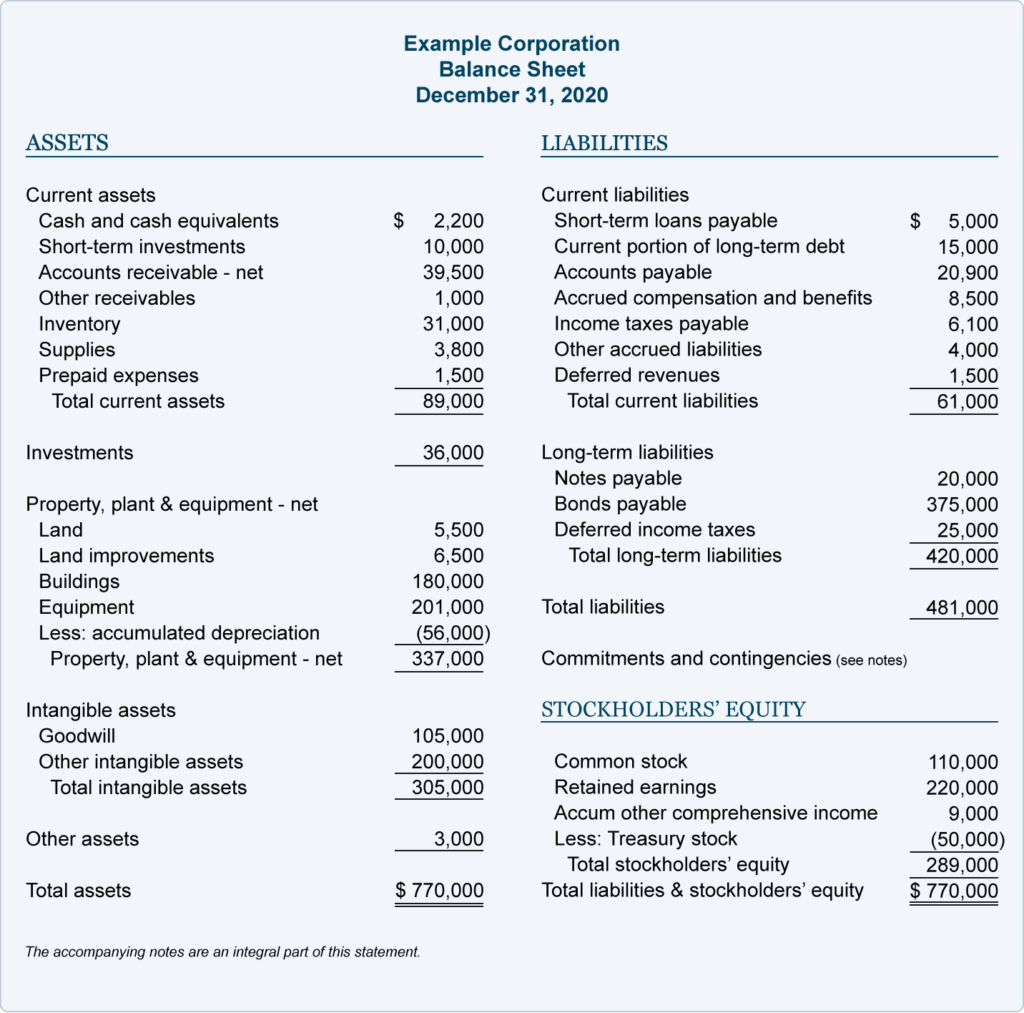

This financial statement lists everything a company owns and all of its debt. A company will be able to quickly assess whether it has borrowed too much money, whether the assets it owns are not liquid enough, or whether it has enough cash on hand to meet current demands. We’ve compiled free, printable, customizable balance sheet templates for project managers, analysts, executives, regulators, and investors. Use these balance sheet templates as financial statements to keep tabs on your assets (what you own) and liabilities (what you owe) to determine your equity.

Assets section

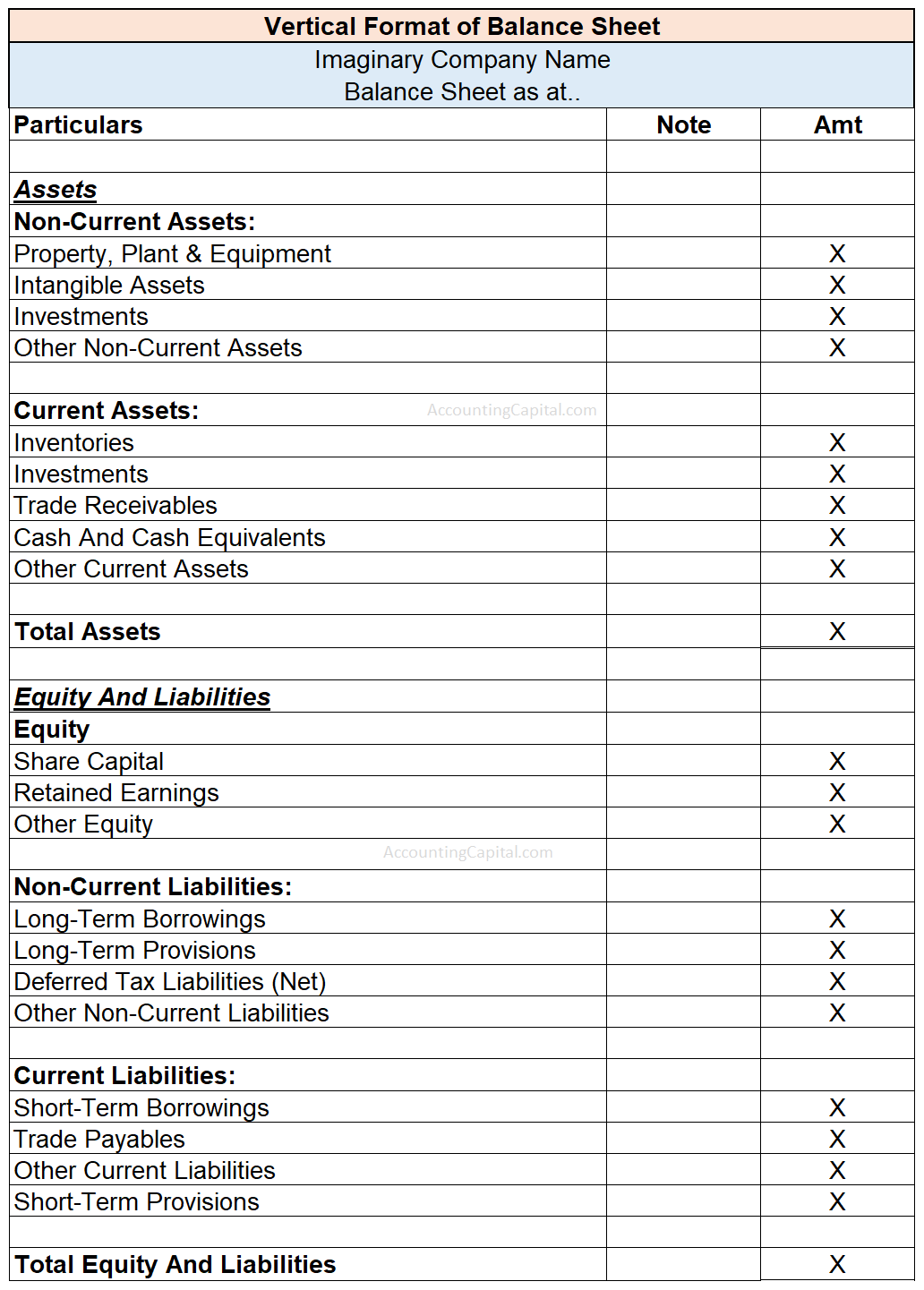

Enter line items to quickly calculate your current and long-term assets, current and long-term liabilities, and owner’s equity. Once completed, you can identify where to make adjustments to improve profit and net worth. A balance sheet is a financial document that helps provide a snapshot of a business’s finances and gives a view of the business’s assets, liabilities, and owner’s equity. The main purpose of a balance sheet is to see if a business can cover its debts or whether it has gained or lost value over time.

Pro Forma Balance Sheet Template

Balance sheets allow the user to get an at-a-glance view of the assets and liabilities of the company. When analyzed over time or comparatively against competing companies, managers can better understand ways to improve the financial health of a company. Balance sheets of small privately-held businesses might be prepared by the owner of the company or its bookkeeper. On the other hand, balance sheets for mid-size private firms might be prepared internally and then reviewed over by an external accountant. It is important to understand that balance sheets only provide a snapshot of the financial position of a company at a specific point in time.

About Tracking Forms

Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed. For additional tips and resources for your organization’s financial planning, see our comprehensive collection of free financial templates for business plans. After you’ve identified your reporting date and period, you’ll need to tally your assets as of that date.

A medical history form is a questionnaire used by health care providers to collect information about the patient’s medical history during a medical or physical examination. Set up Xero to capture your financial data and it’ll create a balance sheet whenever you need one. It’s a good idea to connect with an accountant or bookkeeper when filling out a template like this.

Do you already work with a financial advisor?

It is crucial to remember that some ratios will require information from more than one financial statement, such as from the income statement and the balance sheet. A balance sheet template is a tool for tallying your assets and liabilities so that you can calculate your equity. Use a balance sheet template to ensure you have sufficient funds to meet and exceed your financial obligations. Designed with secondary or investment properties in mind, this comprehensive balance sheet template allows you to factor in all details relating to your investment property’s growth in value. You can easily factor in property costs, expenses, rental and taxable income, selling costs, and capital gains. Also factor in assumptions, such as years you plan to stay invested in the property, and actual or projected value increase.

- For mid-size private firms, they might be prepared internally and then looked over by an external accountant.

- A balance sheet is also different from an income statement in several ways, most notably the time frame it covers and the items included.

- For small privately-held businesses, the balance sheet might be prepared by the owner or by a company bookkeeper.

- A balance sheet provides a summary of a business at a given point in time.

- Use these balance sheet templates as financial statements to keep tabs on your assets (what you own) and liabilities (what you owe) to determine your equity.

In contrast, the income and cash flow statements reflect a company’s operations for its whole fiscal year—365 days. This practice is referred to as “averaging,” and involves taking the year-end (2023 and 2024) figures—let’s say for total assets—and adding them together, then dividing the total by two. This exercise gives us a rough but useful approximation of a balance sheet amount for the whole year 2024, which is what the income statement number, such as net income, represents. How assets are supported, or financed, by a corresponding growth in payables, debt liabilities, and equity reveals a lot about a company’s financial health. For now, suffice it to say that depending on a company’s line of business and industry characteristics, possessing a reasonable mix of liabilities and equity is a sign of a financially healthy company.

The balance sheet only reports the financial position of a company at a specific point in time. Adding total liabilities to shareholders’ equity should give you the same sum as your assets. Line items in this section include common stocks, how to record a loan payment that includes interest and principal preferred stocks, share capital, treasury stocks, and retained earnings. After you have assets and liabilities, calculating shareholders’ equity is done by taking the total value of assets and subtracting the total value of liabilities.

Without knowing which receivables a company is likely to actually receive, a company must make estimates and reflect their best guess as part of the balance sheet. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. It is also helpful to pay attention to the footnotes in the balance sheets to check what accounting systems are being used and to look out for red flags.

It should not be surprising that the diversity of activities included among publicly-traded companies is reflected in balance sheet account presentations. In these instances, the investor will have to make allowances and/or defer to the experts. If spreadsheets work best for you, keep things simple with the balance sheet template Excel.